Part 0, the prologue, describes how new-coming investors fall victims of crypto gaslighting, and how sad it is. Duh.

This post begins a series of publications set to elaborate on the investment theses as seen by our team at DeepWaters. It is largely, though not exclusively, revolving around Solana which is why I’d like to quote Mert Mumtaz:

CEO of Helius Labs, one of the most prominent Solana teams, realised they are working on a good blockchain on May 15, 2024. Tip-top, lovely!

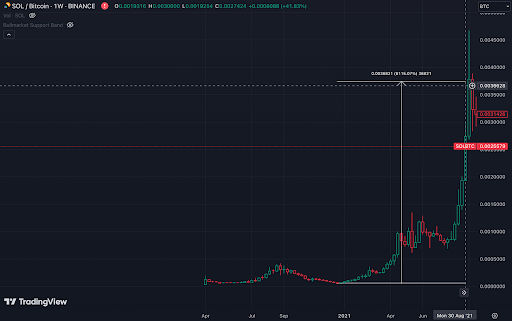

I, a non-technical moron co-running a small family office, managed to realise that much-much earlier, late summer 2021:

I thought I was a genius. Lol?

Jokes aside, though, back then (2020–2021) I was just entering the space, trying to make sense of the whole cryptoverse thing.

Besides DeFi, the narrative was “Alt Layer Ones”. Everyone understood Ethereum had to scale. Everyone understood it couldn’t. Everyone was talking about alternative layers that could. Things like Tezos, Cardano, and some such were a really hot topic.

I didn’t get any of them though. It was never clear to me why crypto people would dub ‘an alternative’ something that typically launches with a great hype, ships shit, faces liquidity challenges, and pivots to “EVM-compatibility” i.e. goes back to square one.

Why would they go back to square one? The wisest owls from the ICO cycle kept telling me ‘there’s no other way, mate.’ The argument was that L1s are bound to connect to ETH because that’s where all the devs are, and that’s where the liquidity is. And as a developer you want to tap into the large user base possible (of, like, three-four dozens real users, perhaps). Somethin’ somethin’ path dependency, somethin’ somethin’ Lindy. It was never clear to me why crypto people would dub ‘Lindy’ something that is 3 years old.

A load of gaslighting, if you ask me. Still, the newcomers like myself would nod and note, because … hey, what do we know? This space is special, innit.

Amongst that swarm of ‘alternatives’, however, there was one chain that in my ignorant opinion was differentiated. Solana shipped shit alright and faced liquidity challenges just like any other chain but they never even talked about going “EVM-compatible”. They never seemed to have wanted it. And I wondered: “Why is that?” How come all my frens are well aware of EVM-compatibility and those ex-Qualcomm gigachads aren’t?

EVM-compatibility narrative would later transform into the narrative of “modularity” popularised by Celestia. L2s would be the infra of choice, the “rollups” as a topic would be reinvigorated and whole chains would migrate to be Ethereum rollups in order to remain relevant. The most resounding VC rounds at multi-billion valuations would be rollup-centred infrastructure like Celestia, LayerZero, Scroll, EigenLayer and so on.

Data source: Crypto Rank — Crypto Fundraising Recap: Kеy Developments of 2023

The space remained to be ETH-centred. The entirety of “top blockchain projects by funding” in 2023 remained to be directly dedicated or significantly dependent on Ethereum ecosystem. Even the next-generation high-throughput systems like Sei or Monad have been dedicated to “unlocking EVM potential”.

One might almost be forgiven to experience a déjà vu — isn’t it essentially the same as the “EVM-compatibility” wave from last cycle? Why would you degens want to repeat the whole thing all over again? If you are dealing with the system that cannot scale and you need scaling for mass adoption — why would you concentrate your building efforts around the system that cannot scale?

Thinking from the first principles, how can it make any sense to anyone? It does though, and there is a whole range of argumentative points behind the modular scaling, which we will discuss later in detail but I’d like to highlight that

Just like the last cycle, Solana continues to be essentially the only full-fledge alternative system to Ethereum universe that has managed to attract a meaningful demand while being sufficiently decentralised.

Other systems are either very promising but not yet battle-tested, others — can only achieve high throughput in theory because they are essentially modular inside, most are just utterly useless or have nothing to do with DLT at all.

In 2023 you might think Solana had its revival moment. Particularly around the EOY where Jito and Jupiter have publicly arrived (or announced).

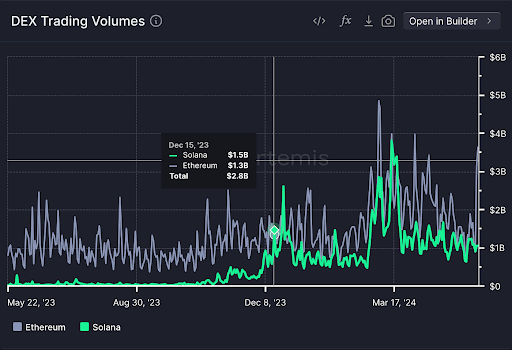

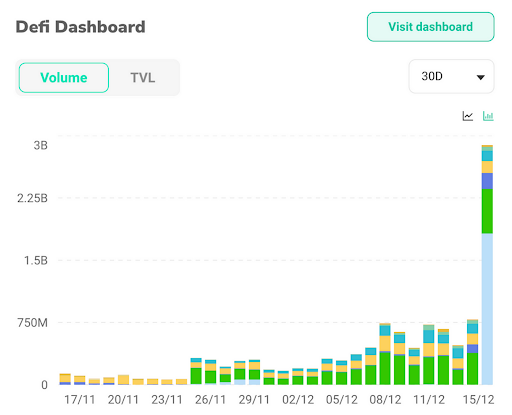

Dec 15, 2023: SOL flippens ETH in 24h DEX Volume for the first time. Something we will get used to in 2024 so that it will stop being news.

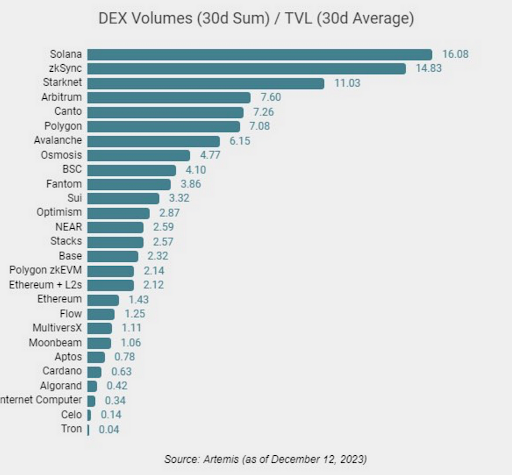

DEX Volume / TVL = DeFi velocity flippening i.e. how much of a trading activity can the given amount of liquidity facilitate. Btw, Solana had been the first chain by this metric for the entirety of 2023.

The fist widely recognised DeFI activity splash on Solana, mid Dec 2023, largely related to Jupiter that flippened Uniswap for the first time then — also something we will get used to in 2024.

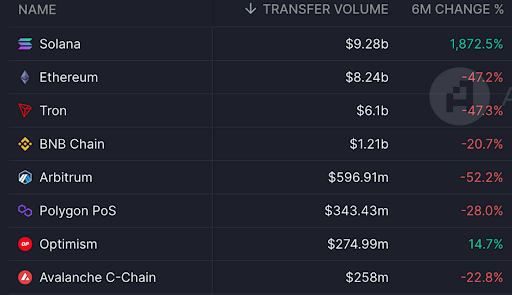

Total stablecoin transfer volume, same dates ~15–16 dec 2023

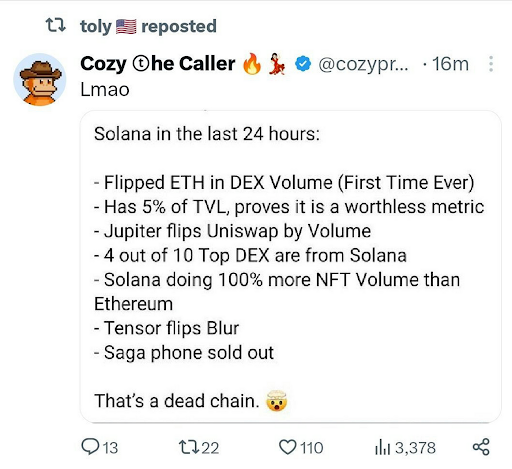

Other major events got widely noticed by crypto twitter

Imagine living through such events and realising they do not pertain the rivals; Instead, the hot one is actually priced at a 9x discount: market capitalisation of Ethereum was ~$270b against Solana’s $30b.

These events stayed with us hovering around this onchain parity levels throughout 2024 and eventually led to the flippenning of flippenings:

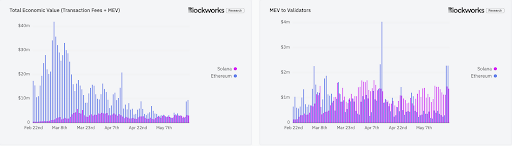

MEV earned by validators + TX Fees

MEV flippening occurred in March and it sparked huge debates and boos from Ethereum community arguing about details and definitions as to how and what exactly should and shouldn’t be counted as MEV. It was also argued that Ethereum should be counted as a whole ecosystem with all the rollups and their rollups and the rollups of those rollups as well as their aunts and turtles to be considered a fair comparison.

Be that as it may, Dan Smith from Blockworks (do subscribe, btw) proposed Total Economic Value (= MEV + TX Fees) as a metric of economic success of a given chain, which makes a ton of sense to me.

Solana is outperforming Ethereum, L1 against L1. And yet. And yet. And yet.

Crypto Twitter largely remains “modular”. At any conference, the buzz is always about modularity. Every Layer 2 solution has several dozens of advocates on top of the proponent layers of Celestia and Ethereum themselves. Venture capitalists are infatuated with the word “modular” on pitch decks. If you search online, the content is predominantly focused on Ethereum, Ethereum L2s, Bitcoin, Bitcoin L2s, or general concept of modularity and how frolicsomely we will be jumping across them once the interoperability is solved.

The newcomer to the space today is facing the same wave of misinformation I faced when I joined in. And this is the reason why I’d like to do my best to present people with a different vision of cryptoverse via a series of Theses articles landscaping everything that has been going on in layman language for the newcomers to familiarise with.

“All the innovation is happening on Ethereum” — a notion that could not be farther from the truth in 2024. It was understandable last cycle in light of Ethereum DeFi summer and absence of anything else on any other chain because they were not ready to ship.

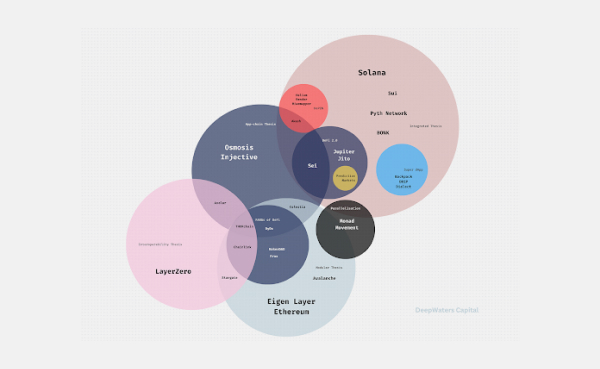

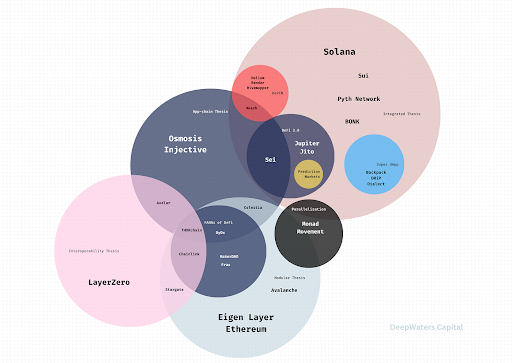

In 2024, however, we at DeepWaters update our Theses Map from time to time and we can’t help but notice that Solana bubble has grown a lot over the last 12 months.

One of many possible ways to view the crypto landscape in 2024.

The semantics can be argued about, and the bubbles changed. One could posit that Modular Thesis should be associated to the Cosmos ecosystem rather than to Ethereum since it was Celestia that initially gave life to the whole narrative. There are countless ways of labeling and categorising things around

But you’ll notice the Solana bubble, which incorporates other theses such as DePIN, DeFi 2.0, Super dApp thesis as well as many others under the common umbrella of “Integrated Thesis” — thesis that nobody is really talking about. Thesis that is, unlike “modular”, not written on the pitchdecks of startups. Thesis, that doesn’t pop up on Medium while uploading this article — you will see “Modular Blockchain” tag but not “Integrated Blockchain”.

I decided to come up with this series of articles once I realised how many people in my personal network, seasoned rangers accustomed to investing across the industry, are just … utterly unaware? of… like, anything besides where the best yield is today.

If Michael Saylor were a Solana bull (which he will be in a couple years and it will be gross), he would say something like this:

You will never find a Solana critic who’d tell you: “I’ve spent one hundred hours studying it, and let me give you my 26 concerns.” Such people do not exist.

Solana the blockchain is grossly misunderstood, and silly people across the internet communicate false narratives about “fake tx count” or “hyper-inflationary economics”. You would think the sentiment has changed now given the aforementioned flippenings but for some reason, neither price action nor the fundamentals can dispel the anti-Solana inertia that still operates via cliches like “the FTX chain”, “the pump & dump assets like Solana” and some bloody such.

It feels like people are just reluctantly tolerating the current events because they have to respect the pump (I dunno) but as soon as the macro conditions change and something goes wrong, they will dank on it harder than on any other system. That puzzles me.

I’m not a Solana maxi but It just pisses me off, really, — to see how under-appreciated and mistreated this absolutely unique system currently is. In the upcoming publications, we will dive deep into the world of integrated thesis in general and Solana design in particular.

In the meantime, do yourself a solid and subscribe to this blog lest you get contaminated with misinformation of where the decentralised innovation truly lives.