Nothing expressed here should be construed as a financial or other advice. Take a stroll down your own research lane, unless you’re aiming to get royally rekt. If you really-really think there’s financial advice being offered, please contact the author for a good scolding.

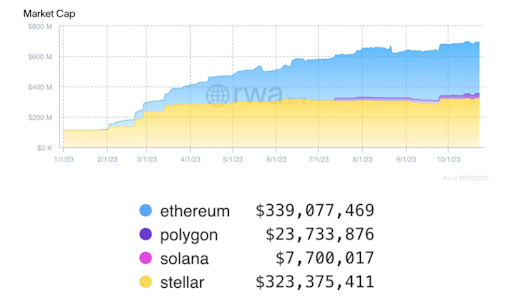

RWA thesis is based on the following premise: as an industry we have barely found any PMF. The only viable use case right now is stablecoins. All the rest is for geeks, devs, and pervs. In order for us to find a firmer foot on the global market, we have to reach out to the real things with real value, and bring them onchain.

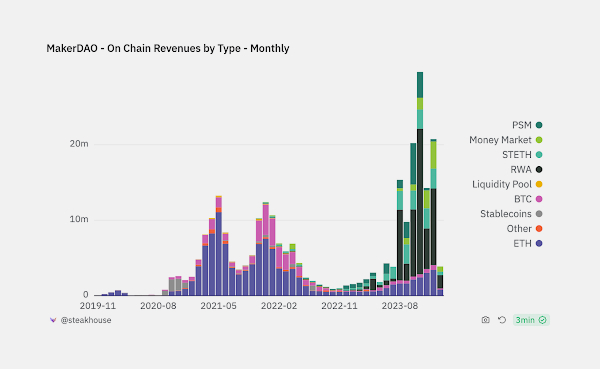

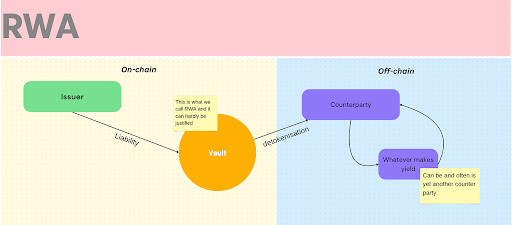

For whatever reason, a lot of high elves are publicly bullish on this worldview, claiming RWA to be the major catalyst for the upcoming cycle. Should we ever embrace this thesis and get excited about MakerDAO annualised earnings, we must immediately realise 3 things:

- MakerDAO earnings are indeed great.

- These earnings do not come from what Larry Fink is talking about (tokenisation).

- They come from MakerDAO internal capital rotation.

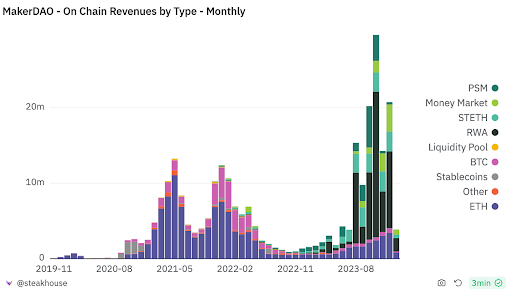

USDC has been flowing out of Maker PSM and off the chain, not tokenising anything anywhere and effectively serving as MakerDAO off-chain investments.

Impressive yield is coming from the balance sheet management

Subtract $2b from PSM module to add $2b off the chain

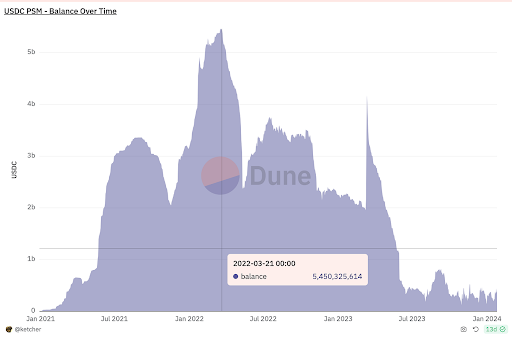

It’s important to acknowledge that, with few exceptions, there is no such thing as tokenised real-world assets on-chain at the moment. The initiatives get explored but believe me, anon, they are not what gets you excited when you hear “RWA”. They are also not what brings in excessive returns, at least for now.

The most commonplace yield-bearing RWA instance currently goes as follows:

- project X creates Vault Y for a dedicated partner Z, which is an incorporated off-chain entity;

- Z borrows from Y to capitalise on it off-chain such that;

- they can return Y to X and there’s still some margin left;

- The canonical way to perform this trick is to use Y for purchasing T-bills and repaying X with the yield.

The whole process essentially means there is just another lending address opened up by platform X.

Different vault, different name, the same business. And that business is lending. Or is it?

Misleading nomenclature

Here’s Sam Kazemian from Frax with a contrarian take for you:

“I like to call myself a stablecoin maximalist. What it means is that I think a lot of stuff in DeFi are effectively stablecoins inasmuch as they are essentially balance sheet management products. You issue a liability, and you can call it a stablecoin, you can call it LSD, you can call it whatever.

The idea remains the same: to make people use your liability as currency. Whether you’re doing your accounting in dollars, or in ETH, or in treasury bills, you have to manage interest rates, and that is what you do. This is the ultimate business model — to use autonomous smart contracts to conduct banking operations such that your liabilities are kept in check. In that sense, a lot of crypto things are just the same as stablecoin issuers. They might not realise it themselves, but the way their protocols capture value is identical to being a stablecoin issuer.

For example, bridges. Their ultimate task is to issue a stablecoin that bears the same brand power and face value as the original native asset. The only feasible way to get long-term traction for such business is to achieve the state of things where their proprietary version of a stablecoin is used the same way as if it were the native stablecoin. “Stable” doesn’t have to mean “one dollar,” it just means “parity in value.””

Makes a lot of sense to me. From this perspective, it would be a mistake to seek an “investment opportunity” separately in lending, stablecoins, LST, LRT, or in RWA treating them as outstanding verticals.

The entire nomenclature doesn’t make very much sense from the first principles as they are all essentially one single management vertical of liability issuers competing directly against each other for the same collateral base (ETH).

Therefore, my hot take is that there’s no such thing as RWA. Just another lending product. We can call it stablecoin business, or lending business, or RWA players. Over time, they are converging into the similar set of services even though their starting points may differ significantly, as per the Hotelling’s Law.

I like to call such projects “liability issuers” or “peggers”, or simply “banks”. The competition inside this vertical is “to accumulate and manage collateral more efficiently than others”.

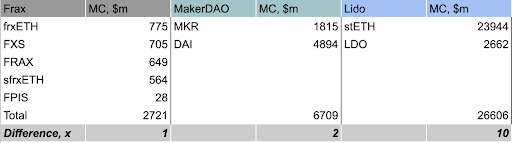

From such point of view, we would have to position things like MakerDAO, Frax, Compound, Aave, Lido, RocketPool and many others together inside one common table of comparables, assuming they directly compete against each other, even though ostensibly belonging to different categories on Coingecko (I wouldn’t expect any of them to acknowledge such competition but what do I know).

The Big Three Ethereum Banks

Besides suggesting Frax’s asymmetry against the others, this optics also raises a question: “How come Maker and Frax have been all this time tightly associated with “RWA” while others — not so much”? There must be something about stablecoins that helps them stand out.

The answer is “seigniorage” model that allows for capturing extra value over every X unit of collateral they receive, essentially becoming “discounted money” suppliers and offering the same quality of service for the broader use cases — stablecoin issuers can easier expand on lending services (which include RWA vaulting) than lending services on stablecoin issuing.

This is the real power of stablecoin business and the reason why people are so bullish on it. This is the reason why Ethena is such a big fuss. This is also the reason why you see AAVE launching GHO and Curve — crvUSD. Many seem to have finally grasped it.

Put simply, you quickly get an upper hand against other peggers once you peg around the most frequently traded price range (~1 USD). Because the most frequently traded price range allows you for the most frequent seignorage extraction while minting your liability.

So, the ultimate “RWA” harnesser in crypto shall be the entity that issues the go-to liability for the collateral of choice, and it makes sense that stablecoin issuers are best positioned to extract value from RWA because the only thing it takes for them is to open another dedicated vault using the excessive collateral, formed as a result of the most frequent seignorage.

Infrastructure matters

Peg maintenance, however, is a tricky thing. The more fractional you are, the less protection you have in case of a black swan event. The less fractional you are, the better you are protected. But every single day of enhanced protection lowers your ability to extract yield for your holders better than those who are under-protected.

A critically important part of this process is the underlying infrastructure. One of the reasons Maker keeps overcollateralisation rate so high is not merely because of safety-first mindset but because of the extremely expensive and inefficient blockspace Maker liquidators are bound to live in. There is a very decent chance of missing an important liquidation, effectively rendering it “bad debt” repaid subsequently with MKR mint. Which is why there’s been this ongoing talk about Maker launching its app-chain, possibly utilising SVM.

Frax went ahead and built its own execution environment on OP for the same reason. Being a successful dApp with established PMF, they start seeking opportunities of escaping the Ethereum base layer which inherently kills thriving economic activity over time (dYdx, Akash, many such cases).

Money tends to find the path towards better velocity and greater composability which is why there’s a whole class of investors who develop this “DeFi 2.0” thesis largely pointing to Solana. But even within that thesis, the definition of “RWA play” is grossly misunderstood as people tend to identify it with things like Parcl. Which is the bets illustration of just how meaningless the concept of “RWA” is.

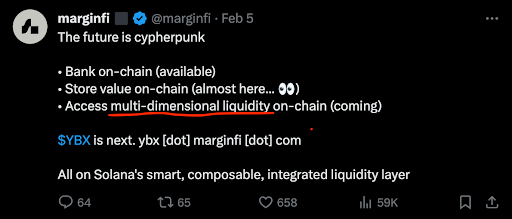

Parcl is a great project but it is just a perps exchange and has nothing to do with issuing high-seigniorage liabilities. People who want to find a Solana RWA play should be paying attention not to this kind of news but to this riddle here:

Lending and what? And stablecoin, of course. Even though it should’ve simply said “the ultimate Solana bank”

The collateral of choice e.g. USDC, or jitSOL, or something else is going to get captured over time by a yield-bearing liability of some quality pegger that is yet to materialise on Solana. Which is a given because, unlike the modular environment, Solana can facilitate a great degree of extra safety for a much thiner balance sheet via the speed with which liquidations happen when sh*t inevitably hits the fan — something you can not do on Ethereum unless you move essentially off-chain.

That means that every Solana-powered pegger has an inherent upper hand against the equally skilled pegger on Ethereum. The underlying tech allows for better damage control via leveraging speedy liquidations, meaning much higher capital efficiency and economic velocity.

Money has a tendency to flow towards efficiency and velocity. All the rest is a matter of time. From that perspective, it’s interesting to notice how much of asymmetry there is to it:

~50x upside potential for Solana-powered banks

Right now, there is no Solana-native yield-bearing liability manager.

There have been, however, two teams that officially announced plans of issuing stablecoins — Jupiter SUSD (designed exactly so that it can squeeze the max of Solana speed for timely deleveraging) and MarginFi YBX.

In this regard, it is a play with infinitely more asymmetry and just as much of “RWA exposure” as it currently stands in terms of bringing extra yield. An RWA believooors could do themselves a solid by playing it smart and following the stablecoins for this is where RWA thesis actually thrives.